Contactless cards, online shopping and the ability to ‘buy now with one click’ have all been brought into focus following recent developments in technology and the global pandemic. The way we pay is rapidly evolving, particularly as it adapts to our socially distanced lifestyle. Can we even go so far as to say that cash payments will one day become obsolete? Myriam Dassa, Head of the Natixis Payments Observatory, and Vincent Maissin, Head of Strategic Partnerships and responsible for the monitoring of Natixis Payments, break down this ever-growing phenomenon and what it will mean for the future of payments.

The way we buy and sell is becoming more and more virtual and, in an age where everything is so fast paced and automatic, hard cash is disappearing. Olivier Dussopt, Minister of Public Accounts, demonstrated this transition before the National Assembly, where he presented the new tax exemption measures for gratuities which will come into place from the fall of 2021. Electronic and digital payments are becoming more and more popular and replacing hard cash.

Vincent Maissin explains:

The pandemic has played a huge role in accelerating the transformation in our ways of paying, which began several years ago, and physical forms of payment are being replaced by digital ones.

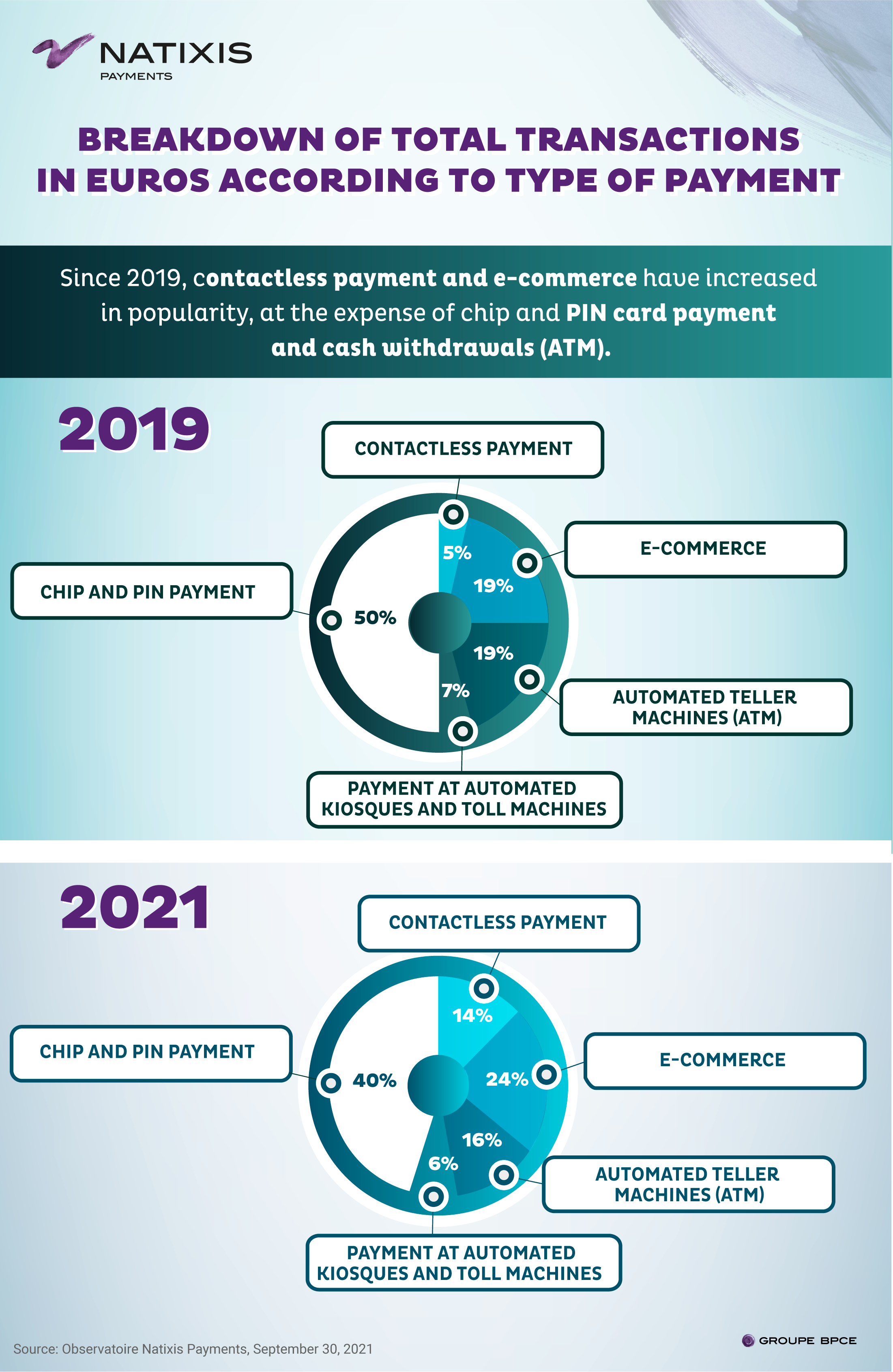

“We can see that hard cash has been deeply impacted- ATM withdrawals have reduced by 27% this year compared to 2019 and check usage continues to decline at a similar pace. As well as this, contactless payment has become firmly embedded in our day-to-day life. After the first lockdown, contactless even became preferable to traditional chip and PIN payment and today, it makes up 59% of total card transactions.Online shopping has thrived as a result and increased by 19% per year and this trend is on track to continue.”

Bank cards: Pioneering cashless payment since 1967

This fundamental shift began long ago. The bank card or ‘credit card’ was first introduced in France in 1967 by six banks: Crédit Lyonnais, Société Générale, Banque Nationale de Paris, Crédit Industriel et Commercial (CIC), Crédit Commercial de France (CCF) and Crédit du Nord. The first ATM followed shortly after, but it wasn’t until 2001 that card payments became more popular than checks and digital bank cards, which were initially intended for online payments, emerged. Twenty years later, smartphones are becoming the primary device for digital payments. Towards the end of 2019, according to a study by FEVAD done on 9th July 2020, mobile phone payments increased by 23.7% (or 16.3 million users) and 49% of consumers paid by smartphone at least once a month. The recent lockdowns, triggered by the global pandemic, have accelerated this trend. In the space of three months, contactless payments shot up by 60% and 55% of internet shopping is done on smartphones.

Contactless payment as a response to the pandemic

Myriam Dassa points out: “Thanks to online shopping platforms and new digital solutions like mobile wallets, which operate contactless technology, these last few years have seen a major shift in the way we pay. New trends have emerged as a result: a surge in smartphone payments and a drop in ATM withdrawals, due to an increasing inclination for online shopping. Contactless payment has also been crucial in preventing the spreading of the virus. As a result, there is less and less demand for physical money and ATMs. The Payments Observatory records this global transformation which was sped along by the pandemic. The latest study, which focused on ready-to-wear fashion, recorded that one in three purchases carried out in this industry is done online. Last year, it was one in five. Perhaps next year it will be one in two.”

Natixis anticipated the arrival of Apple Pay and Samsung Pay

As the first payments operator to develop Apple Pay and Samsung Pay (the device payment solutions by offered Apple and Samsung respectively) and instant payment in France, Natixis Payments has been ahead of the game for a while now. Myriam Dassa explains: “When banks first introduced contactless payment, it was intended as a means of shortening checkout queues. To anticipate the future, you need to know how to truly listen. We are always ready to listen and respond to our clients in order to find payment solutions which facilitate their everyday life and are adapted to different industries such as hospitality, textiles and medicine. Moving away from cash payments benefits everyone: shoppers don’t have to worry about keeping track of loose change, the government can better monitor transactions and retailers don’t have to spend time cashing up tills and counting out change. Thanks to the Observatory, which tracks changes in payment trends in each sector, we can better accompany retailers in their digital transition and help them respond to consumer trends“.

2022 is likely to see yet another transformation in the way we pay

Every day, new payment solutions are discovered which are more convenient, secure and innovative. Vendors can use new software, developed by start-ups which manage every stage of online transactions, from advertising to online booking, from browsing right up to paying the bill and even giving a tip now too. Vincent Maissin confirms: “The anticipation is even greater with regards to advertising strategies, digital tracking and the management of transnational operations. This goes hand in hand with a thorough grasp of data, which has become crucial in enabling us to effectively combat fraud whilst also improving the consumer’s experience. Following the European development of Instant Payment, which enables bank transfers to be carried out in under 10 seconds, the introduction of Request-to-Pay (RTP) will be implemented from 2022. This will enable billers (retailers, institutions, money lenders and individuals) to send out requests for bank transfers to the billpayer through a mobile banking app. This kind of messaging service has already been implemented by certain countries, such as the United Kingdom and India, and it simplifies payments (such as tax deductions and claim settlements), whilst also making them more secure. In the future, this kind of transformation will continue to grow, particularly with the large-scale shift towards cryptocurrencies. The ‘digital euro’, proposed by the European Central Bank, is likely to emerge in the next two to five years.” We should keep up to date with these developments, so that we can anticipate the impact they will have on our daily life and activity.

Despite the increasing digitalization of our payment methods, notably in response to the pandemic, paper money is still frequently used by consumers in France and Europe as a whole. As it stands today, hard cash is still being used in all countries around the world. Even in Sweden, a country renowned for being at the forefront of this transition, the government passed a legislation in 2020 which requires banks to offer their services in cash. In France, in 2019, a report filed under the aegis of the Minister of the Economy and Finance insisted on the importance of easily accessible cash for the entire French population.

Glossary

- Digital Euro : The digital euro would still be a euro: like banknotes but digital. It would be an electronic form of money issued by the Eurosystem (the ECB and national central banks) and accessible to all citizens and firms.

- Request to pay: RTP is a messaging service that has been created to complement existing payments infrastructure and gives billers the ability to request payment for a bill rather than simply sending an invoice.