Learn all about blue finance by listening to this Q&A featuring Ivan Pavlovic and Radek Jan, Infrastructure and Green & Sustainable Analysts at Natixis.

In brief

- Most of our water consumption remains “invisible”, which is why water is rarely understood and poorly managed.

- Most water-related issues rely more on managerial aspects than on technological solutions.

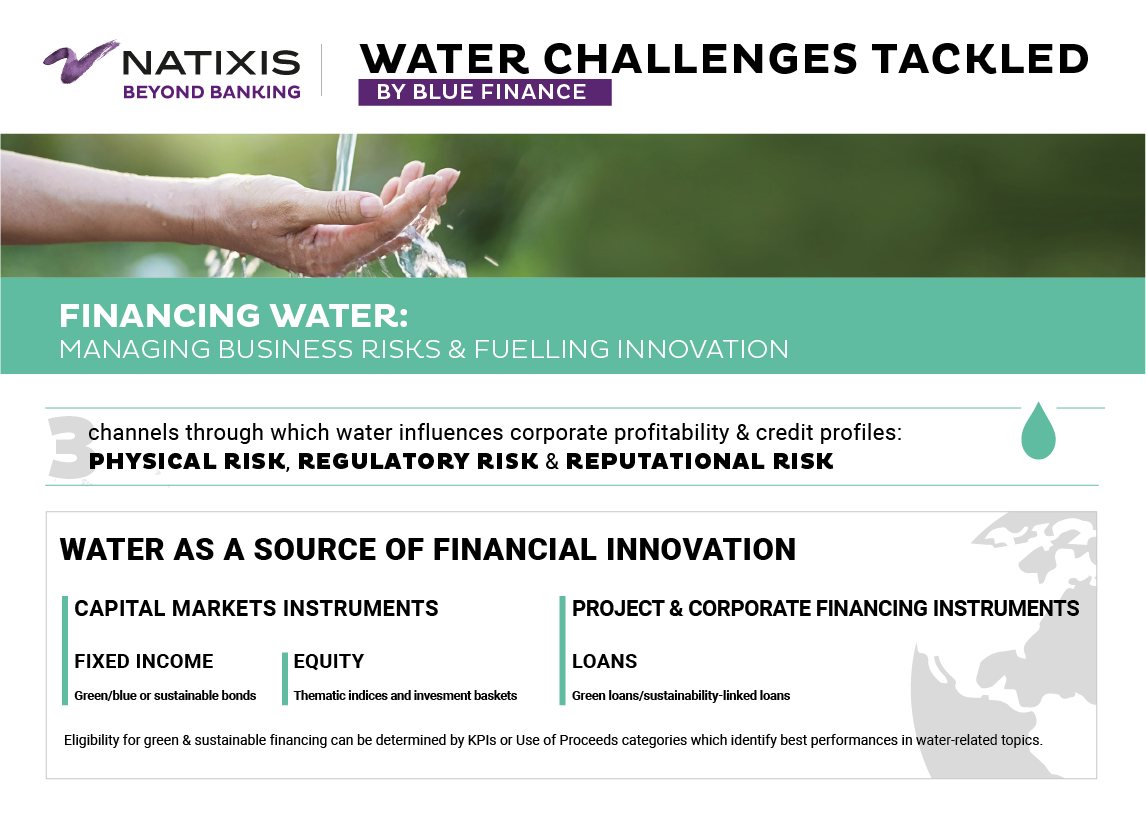

- New and existing financial instruments - be it green / blue bonds, loans or indices – are effective in encouraging businesses and companies to better tackle these challenges.

Did you know that the vast majority of our water consumption remains “invisible”?

The Water Footprint concept has been developed to account for the full water impact of human consumption choices. It takes into consideration water use at different stages of the supply chain. For illustration, a pint of beer requires almost 150 liters of water to be produced. A pair of jeans can easily have a water footprint of 8 000 liters, and meat accounts for around 15 400 liters of water for 1kg of beef steak production.

Source: Adapted from the UN FAO, the Water Footprint Network, Mekonnen and Hoekstra (2016)

Water challenges are unquantifiable

Ocean and sea water covers 71% of the Earth’s surface, which is why the Earth is nicknamed the “blue planet”. Only 0.75% is freshwater available for humanity. One simply can’t imagine human activity without water.

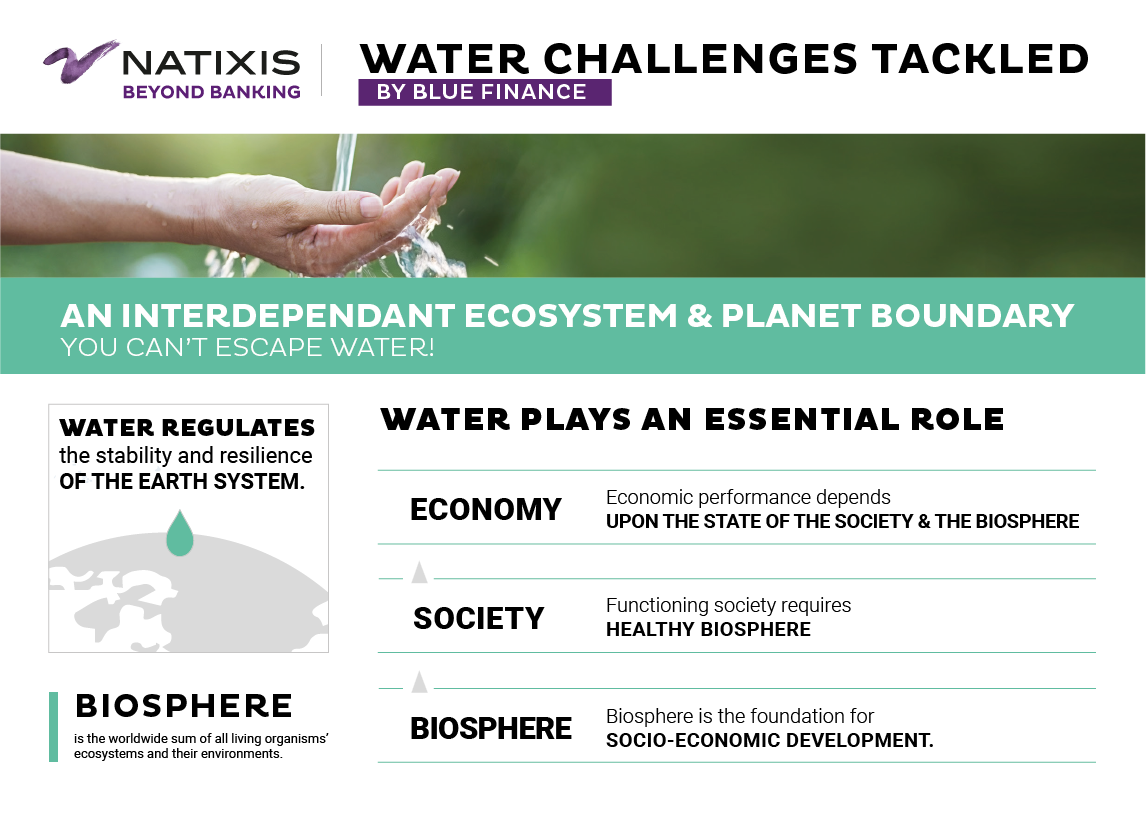

Water plays an essential role in ensuring that the biosphere can continue to support human development. It also pervades economic activity and remains a key ingredient for social development. And yet, despite being everywhere, water is rarely understood. What is not understood is rarely well managed. Hence, water resources are often mismanaged, overexploited and polluted. Water pollution resulting from human activities comes in multiple forms from a wide variety of sources. Combined, they reduce the quantity of water available for human use, inflict damage to ecosystems and human health and imposing additional treatment costs on businesses.

For these reasons, water pollution engenders a wide range of economic costs, many of which are not easily expressed in monetary terms. The fundamental water challenge is managerial rather than technological. The solutions to water challenges can often be found in better policies, more efficient managerial procedures, new business models and partnerships rather than in cutting-edge technologies.

Source: Adapted from Stockholm Resilience Centre

Finance impact and innovation

Multiple challenges can be tackled provided clients and investors can access appropriate forms of financing and advisory services. In terms of solutions, financing through debt capital markets can be mobilized thanks to green bonds while project and corporate financing can be accessed through green loans pertaining to sensible/virtuous water solutions. Equity capital markets can also take their part thanks to investment solutions such as thematic indices composed by stocks of companies selected for their strong performance in water-related topics.

Discover and read the full Research report Water economy: deciphering the challenges, financing the opportunities.

Key concepts

Water footprint: Concept to quantify and localize water needed to produce the goods we buy. Most of the water we consume is “hidden” in the production chain.

Water scarcity: Lack of available water resources of sufficient quality to meet the water use demands in a certain area. Scarce water availability results from physical unavailability or pollution of water resources while scarce water access results from mismanagement of available water or lacking water infrastructure.