SRI and social impact savings products are enjoying roaring success. These investments – supporting socially or environmentally beneficial projects – were long viewed as finance easing its conscience, and have been growing since the 1990s. With the traditional economy currently suffering a hefty blow from the health crisis, these products chime particularly with investors, and they carry attractive yield to boot. Karen Charbonnel, Head of Corporate Development at Natixis Interépargne*, and Fabien Leonhardt, senior fund manager at Mirova, managing the mutual fund Insertion Emplois Dynamique, are both in favor of actively informing staff on these products, working side-by-side with savers and supporting job creation in France.

* Natixis Interépargne, Groupe BPCE’s employee savings and pensions company, supports 75,000 client companies and 3 million individual investors.

How do SRI funds and social impact savings address today’s fundamental needs?

Fabien Leonhardt: As early as 1972, researchers at the Massachusetts Institute of Technology (MIT) discussed the idea of an ecological footprint in their Meadows report, and demonstrated that the earth had limited resources. At the time, humanity used up 0.7 planet per year, while the figure now stands at 1.7, which is clearly unsustainable. Since the launch of Mirova, Philippe Zaouati has been convinced that responsible investment would become fundamental. Natixis gave us the leeway to develop funds that really seek to deliver the greatest impact possible, and we have proven that it is possible to combine performance, a demanding approach and investor support.

Employee savings are currently the main contributor to social impact investing

Karen Charbonnel, Natixis Interépargne

How can employee savings promote the development of social impact savings and SRI?

Karen Charbonnel: Employee savings in France currently act as the largest investor in social impact savings. Since the so-called Fillon law in France, which requires companies to offer at least one social impact fund in their savings plans, we have seen huge success. Employees often start to invest in social impact savings as their companies include SRI funds in their programs: this framework offers trust and yield is also present. At Mirova, companies are rated on a scale from one to 1 to 5 (engaged, positive, neutral, high-risk, or negative) and we only include the best ratings in our portfolios, with a very large majority of positive and engaged companies. Of course, we provide our corporate clients and our individual investors with monthly non-financial SRI reports. Investors who choose SRI investments are informed and have fully grasped the usefulness of this approach, so it is entirely natural to keep them informed of our commitments.

What are the particular features of Mirova’s Insertion Emplois Dynamique fund?

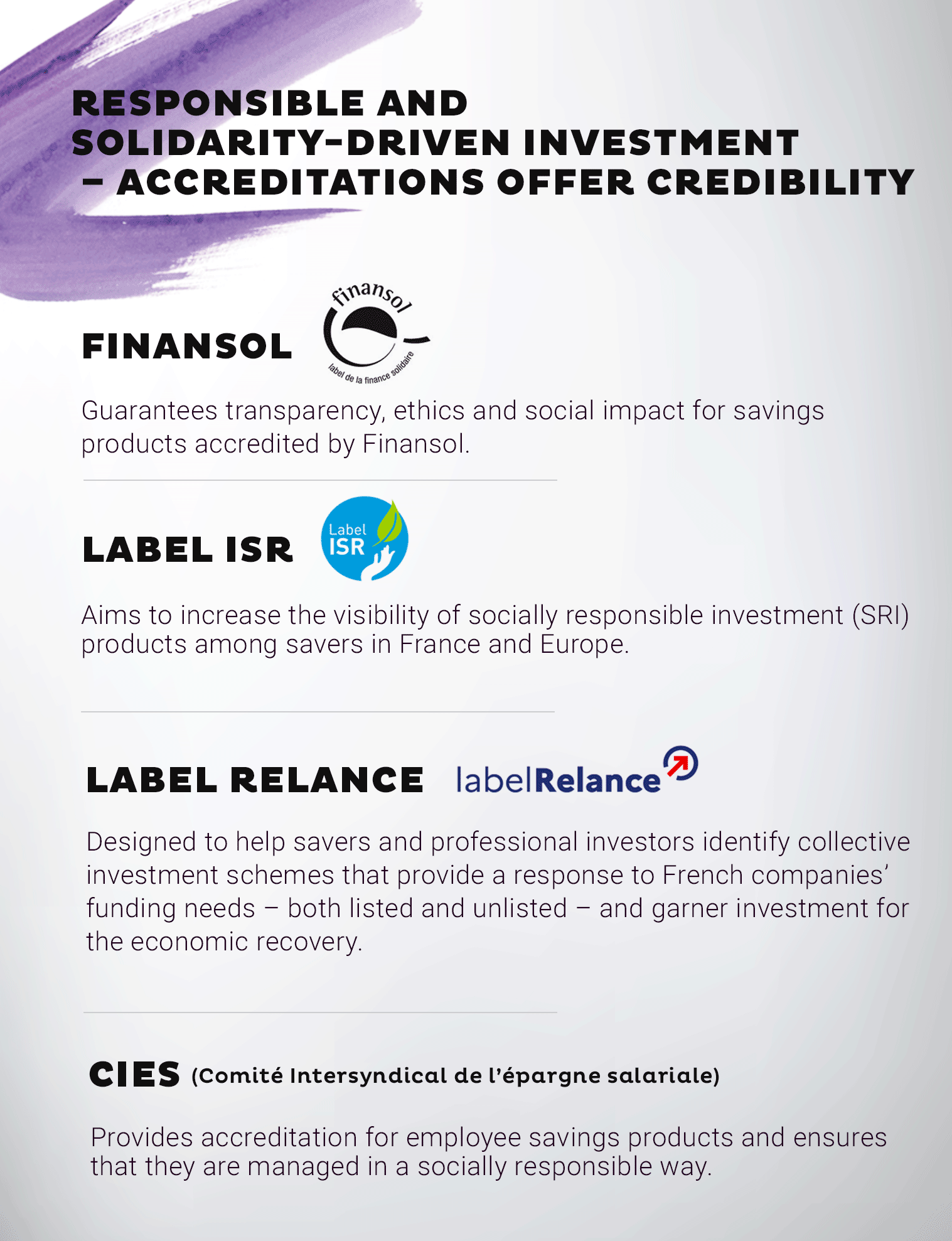

Fabien Leonhardt: Our Insertion Emplois Dynamique (IED) fund has been around for 25 years and is designed with two components. The listed portion (90%) invests in listed companies – large French groups where staff numbers are growing or remain stable, large international groups with a growth strategy in France, and SMEs with substantial growth. We select these companies on the basis of their compliance with our non-financial requirements and their job creation prospects in France over the next three years, on the basis of Mirova’s analysis. IED has three accreditations – CIES* employee savings committee, SRI / Finansol and has just been awarded the new French Relance label, certified by the French Ministry for the Economy and Finance.

Assets managed by the fund come to €850m as at end-October 2020, making it the largest on the market. Our primary conviction is that job performance is positively correlated to a company’s financial performance, and this is borne out in our impact report (the latest was issued in October 2020): listed companies with the strongest job creation trends in France made the greatest contribution to the fund’s financial performance over the past 3-year and 5-year periods (period: end 2014-end 2019).

Alongside this listed portion, 5-10% of the fund’s assets are devoted to solidarity economy investments, so for each million invested in the fund, on average €75,000 goes to social impact financing.

What is your strategy on the social impact portion?

Fabien Leonhardt: The social impact portion (5-10% of assets or €47.4m) currently directly finances structures that can demonstrate their strong social impact i.e. companies that get people back into the workplace, companies that employ staff with disabilities, charities or so-called ESUS, which is the new generation of social impact companies. We work locally in partnership with France Active, the social impact finance pioneer, and support prize companies such as Simplon, which supports staff as they return to the workplace via digital businesses, and also AfB France, which employs staff with disabilities, where such workers can repair, recycle and resell IT hardware.

There is now a real shift towards funds with a clearly measurable non-financial impact

Fabien Leonhardt, Mirova.

What role do accreditations play in SRI and the solidarity economy?

Fabien Leonhardt : The four labels in France CIES, SRI, Finansol and Relance CIES, SRI, Finansol and Relance provide funds with official recognition and reassure savers that a proper, documented and verifiable approach is being taken. Our IED (Insertion Emplois Dynamique) fund carries these four accreditations. There is a real social impact for savers from all companies in our fund, as we can monitor the number of staff and the jobs created. The investments we offer are solidarity-based and responsible, and we are also convinced that they offer strong performances over the longer term, as they direct funding to the healthy portion of the economy. All non-SRI funds are now suffering outflows, and there is a real shift towards funds with a clearly measurable non-financial impact.

How can you provide greater visibility for these types of investment?

Fabien Leonhardt: It is crucial to focus on greater proximity and enhanced traceability, and all our systems work towards this goal. In our annual impact report, we outline our approach and detail the number of jobs created. We also provide two interactive maps, one on the social impact portion and the other on the listed equity portion to enable investors to clearly identify and locate the companies we support. This transparency offers an assurance of credibility.

Employee savings Employee savings are also a key way of informing investors and have been instrumental in developing SRI and social impact savings. Mirova manages a large portion of the employee savings collected by Natixis Interépargne, and employee savings’ use of this approach has really been a driver for the sector’s development, with close to 30% of employee savings assets invested in this segment.

Karen Charbonnel: There was a degree of criticism of SRI at the outset, with detractors saying that with standard financial management you win, and with SRI you lose. But today we are seeing real performances, and companies that comply with certain criteria are the most healthy over the long term.

However, most savers who want to support SRI do not know where to begin, as 65% feel that environmental and social impacts have an important role in their investment decisions, but 76% are unaware of equity and bond selection criteria for the SRI funds they have invested in. SRI still remains a finance of experts, but if we want to further develop SRI and the solidarity economy, we need to inform and communicate more on the real impact of these funds for the economy.

Should savers move towards SRI and social impact investments?

Karen Charbonnel: It’s always the right time to look at these investments, but with the range and complexity of different systems, investors who are planning for retirement often feel lost and as an easy option they go for more liquid investments that carry very low returns, such as the livret A savings book in France, which is eaten into by inflation. This is disastrous for savers, as well as companies, which are not being financed by these funds.

When and how should investors build up their savings?

People generally start thinking about their savings around the age of 40-45 as they think about retirement, which is a time when income will decrease. However, we should all set aside savings as a precaution in case we fall on hard times.

Right from the age of 25, if possible it is better to set aside a little every month than shell out a huge amount once a year, as this makes it easier to build up savings and also helps smooth out any fluctuations on the financial markets, notes Karen Charbonnel.

What are your plans and what is the timeframe? Do you want to move house? Finance your children’s schooling? Prepare for retirement? Once you have thought about these questions, the further down the line your project is, the more attractive it is to invest in equity funds, which carry higher returns over the longer term.

Definitions

Socially responsible investment (SRI): this type of investment seeks to combine economic performance with social and environmental impact by financing companies that contribute to sustainable development across all business sectors.

Social impact savings cover savings and investments that focus on financing socially useful activities. Funds collected are mainly allocated to the social sector (inclusion through employment, social housing, etc.), the environment (organic farming, renewable energy, etc.) and international solidarity (support for communities in developing countries, etc.)