Our platform dedicated to natural capital investing managed by Mirova and Athelia Ecosphère develops solutions to address climate change, protection of landscapes, biodiversity, soil and marine resources.

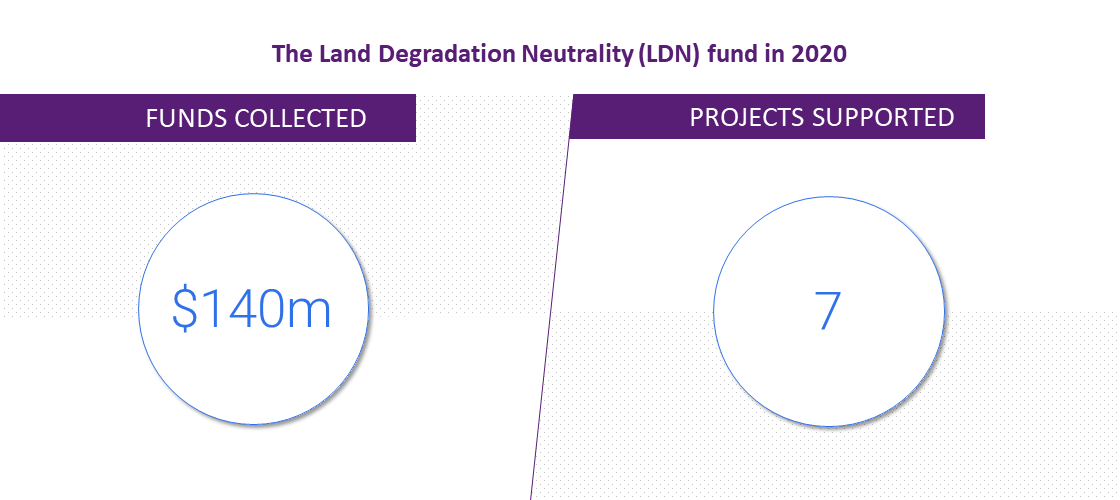

The Land Degradation Neutrality (LDN) fund

Mirova’s Land Degradation Neutrality (LDN) fund is designed to restore degraded land, and has collected $150 million since 2019. The fund is geared towards generating positive environmental and socio-economic impacts:

- Land degradation neutrality;

- Mitigating climate change;

- Adapting to climate change;

- Improving livelihoods;

- Enhancing biodiversity.

After supporting a first project in Peru in favour of agroforestry systems for small coffee producers, three land restoration projects in 2019, Mirova invested in three new projects in 2020: a social enterprise that helps local populations to plan crops trees, an agroforestry project in Bhutan, and a sustainable forestry company in Ghana and Sierra Leone.

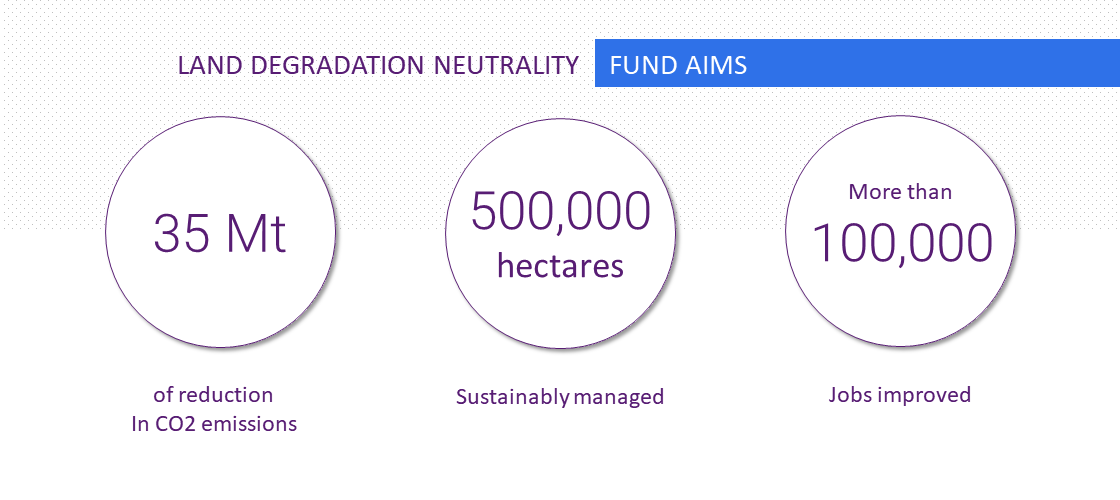

The LDN fund draws on its investments with the aim of achieving the following:

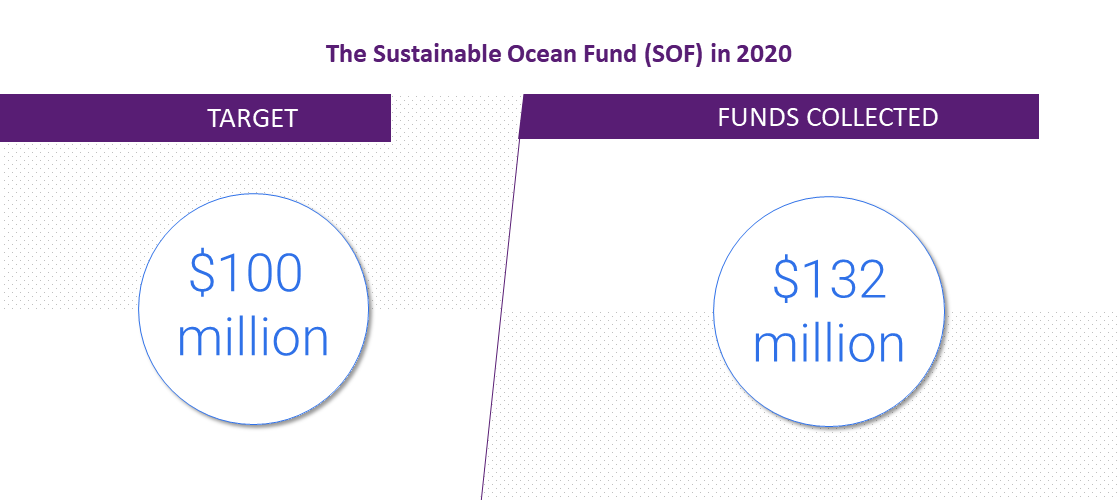

The Sustainable Ocean Fund (SOF)

Mirova’s Althelia Sustainable Ocean Fund (SOF) develops a sustainable portfolio in the seafood sector, the circular economy and the conservation of coastal ecosystems.

It invests in around twenty sustainable projects, such as sustainable offshore aquaculture and efforts to reduce the capture of juvenile fish and non-target species, as these additional catches can sometimes account for 40% of fish caught worldwide.

Structured products devoted to natural capital

The Water and Ocean index range addresses the challenges and risks related to water resources and the preservation of marine ecosystems.

The Euronext® Water & Ocean Europe 40 EW index, developed in partnership with Euronext is based on a comprehensive methodology, with diversified sector allocation to better tackle water-related challenges.