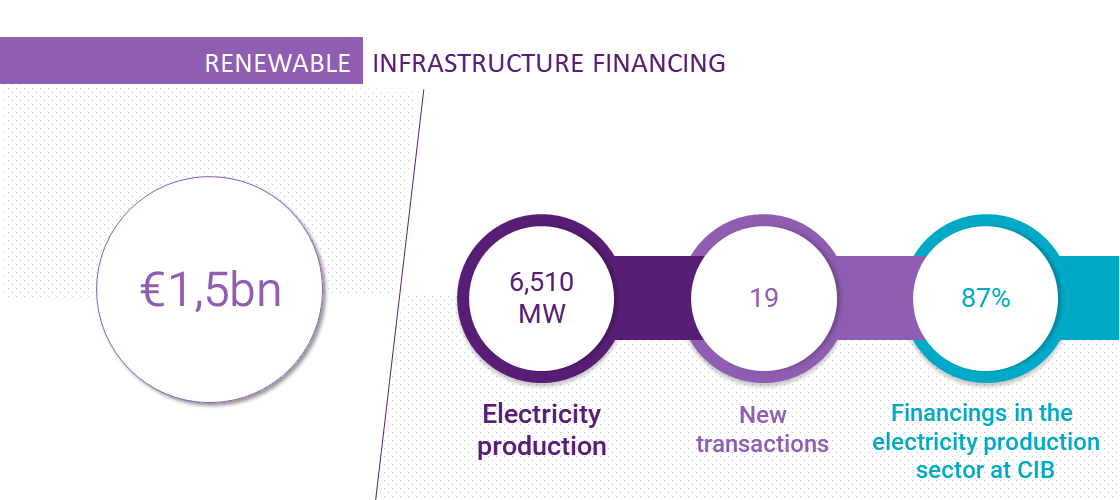

Renewable energy

Natixis is the world leader in renewable infrastructure financing.

Dedicated investment funds managed by Mirova have supported implementation of more than 170 projects since 2002, equating to 2.4 GW in installed capacity.

As at 31/12/2020

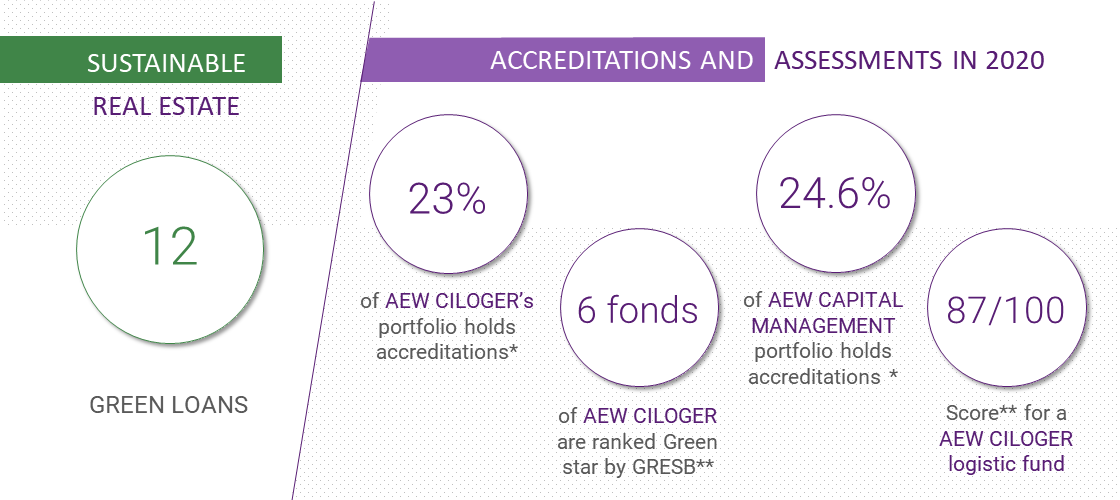

Sustainable real estate

Natixis is a key contributor to the sustainable real estate market via mortgage financing, green bonds, securitization vehicles and green loans. en matière de l’immobilier durable : financements hypothécaires, obligations vertes, véhicules de titrisation, prêts verts.

Our investment management affiliates AEW Ciloger and AEW Capital Management ensure accreditation and assessment processes for assets in their portfolios.

As at 31/12/2020 / Source: *BREEAM, LEED existing building, HQE high environmental quality operating standard or BREEAM in use, BBCE low energy use certification, BEPOS positive energy building standard **GRESB: Global Real Estate Sustainability Benchmark – 2020 assessment

Natixis Assurances supports it individual policyholders in making energy savings via its home insurance range:

- Domestic wind turbines

- Solar panels or water heaters

- Energy regulation panels

- Storage batteries and rainwater recovery systems

Sustainable mobility

We finance and invest in projects offering transportation access for a great number of people while also curbing the environmental and social footprint of travel.

Natixis Corporate & Investment Banking supported Italo Transporto Viaggiatori, the leading private rail operator in Italy, in developing its sustainable ambition by offering it the largest green loan ever made in the transport sector.

Mirova focuses on construction and equipment companies that provide technological solutions to support access to sustainable mobility.

Natixis Assurances offers preferential rates for electric vehicles as well as vehicles that cover less than 8,000 km per year, while it also offers eco-driving lessons.