Our role is to support all our clients in their environmental and social transition and offer financing, particularly for large economic stakeholders.

Julien Duquenne, Global Head of Environmental and Social Responsibility (ESR)

A network of close to 200 correspondents coordinate ESR efforts for all our business lines and support functions worldwide, including in particular.

The Green and Sustainable Hub (GSH) team at Corporate & Investment Banking which provides strong impetus for this network as it supports issuer and investor clients on green and sustainable finance.

The asset management teams dedicated to responsible investment who support our clients in their ESG (Environment, Social, Governance) investments.

Financing social transformation

Major innovations, such as the Green Weighting Factor and the increasing incorporation of ESG criteria into the assets we manage, enhance our position as a forerunning sustainable finance company.

We draw on the framework set out in the 17 Sustainable Development Goals (SDG).

NET ZERO BANKING ALLIANCE

Groupe BPCE is member of the Net Zero Banking Alliance and have committed to make our financing portfolio carbon-neutral by 2050.

The roll out of the Green Weighting Factor is a tool to comply with this goal.

SOCIALLY RESPONSIBLE INVESTMENT (SRI)

Natixis Investment Managers (NIM), Groupe BPCE’s asset management arm, is a signatory of the Principles for Responsible Investment (PRI).

Natixis Investment Managers offers three approaches to applying ESG criteria:

- Responsible investment: inclusion of ESG criteria in research, without these criteria having a systematic impact on decision-making and investment strategies, and implementation of an active shareholding policy;

- Sustainable investment: the investment strategy is based on ESG issues, aiming to align values, financial ouperformance or societal impact through investment;

- Impact investing: strategy that addresses societal challenges such as those defined by the United Nations sustainable development Goals.

Find out more about Natixis Investment Managers’ affiliates.

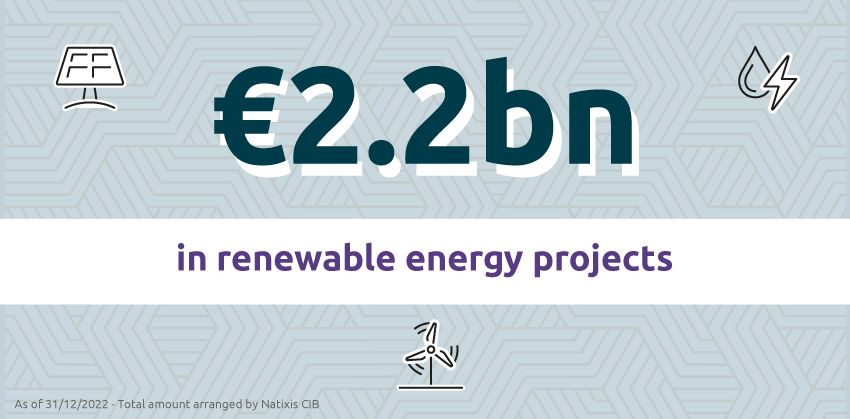

Financing the energy transition and combating climate change

Natixis was named “Most Innovative Investment Bank for Climate & Sustainability” by The Banker*, applauding our efforts to combat climate change and work to support the energy transition.

* 2018 award

Protecting natural capital

Biodiversity and natural capital are crucial in the economy’s running, and vital to a number of services in the ecosystem, such as food and medical resources, while also reducing pollution. It is essential to preserve these ecosystems’ resilience and safeguard their ability to regenerate, particularly as we face the challenges resulting from climate change.

Managing environmental and social risks

Our comprehensive approach to environmental, social and governance (ESG) risks involves all business lines, ESR and control functions. It particularly includes the development and implementation of ESR policies across the most sensitive sectors, as we assess and monitor ESG risks for both transactions and counterparties.

Since 2017, ESR has been managed by a dedicated department, reporting to Corporate Secretary. The department is supported by a network of close to 200 correspondents across all our business lines and support functions worldwide.

Moves to take on board environmental and social risks are a real performance and growth driver for our business lines, as we support our clients in staging their own transition to a more sustainable business model and offer them innovative solutions.

COMBATING CLIMATE CHANGE

Our innovative Green Weighting Factor ® offers effective support in the fight against climate change, as we decarbonize our balance sheet. We also apply sector policies designed to reduce financing for the most sensitive sectors, and manage the greenhouse gas emissions resulting from our own day-to-day business operations.

NATURAL CAPITAL CONSERVATION

Natixis joined the Act4nature International initiative in 2018, and mobilizes all its business lines to offer concrete solutions to preserve and restore biodiversity.

Our commitments most notably include the development of financial solutions to support biodiversity in our Asset & Wealth Management and Corporate & Investment Banking. We have also pledged not to finance projects in IUCN protected areas I and II, in wetlands of international importance under the Ramsar convention or areas listed as UNESCO world heritage sites, and ensure compliance with initiatives to mitigate the impact on biodiversity.

PROTECTING HUMAN RIGHTS

Respect for human rights is a fundamental principle.

- Natixis naturally applies this principle in our human resources management policy, safeguarding working conditions and health and safety in the workplace worldwide.

- We take this on board in our responsible purchasing policy, as we select suppliers and products that incorporate consideration of environmental and social impacts, particularly in terms of human rights.

- Natixis also incorporates human rights aspects into its financing approval process, applying the Equator principles, which require clients to consider the potential environmental, social, health and security risks and effects of their projects, and take all necessary steps to mitigate and address these.

Criteria we take on board in our assessment include:

- Respect for staff (ban on forced labor and child labor, no gender discrimination, compliance with good working conditions)

- Health

- Safety and security of communities

- Acquisition of land and fair compensation for involuntary resettlement

- Remediation of negative impacts on indigenous communities.

We also draw on our inhouse ESR Screening tool to assess ESG risks applicable for corporate clients at Natixis Corporate and Investment Banking.

>>> Consult the Groupe BPCE’s human rights charter (french only)

OUR CONTRIBUTION TO THE SUSTAINABLE DEVELOPMENT GOALS (SDG)

The SDGs were adopted in 2015 by the 193 United Nations (UN) member states during the summit for sustainable development in New York, and provide the foundations for the 2030 Agenda, which sets out 17 worldwide goals with the aim of fighting inequality, exclusion and injustice, tackling climate change and the erosion of biodiversity, as well as putting an end to extreme poverty.

Our code of conduct and our voluntary commitments

Our code of conduct lists rules and best practices i.e. be client centric, behave ethically, act responsibly towards society, protect Global Financial Services businesses, global arm of Groupe BPCE, and Groupe BPCE’s reputation.

We have taken a range of international commitments with financial market working groups to further develop our ESR strategy.

OUR ESR INDICATORS AND PERFORMANCES

OUR NON-FINANCIAL RATINGS

Natixis is assessed by the main non-financial ratings agencies, as we post solid environmental, social and governance performances.

We strive on a daily basis to curb our environmental footprint, support community and accompany our company’s transformation, as our staff are all mobilized to meet these challenges

Cécile Tricon-Bossard, Chief Human Resources Officer