Natixis payments builds ‘payment as service’ solutions right across the entire value chain: from issuing to acquisition, and omni-channel to processing, including data. It draws on robust technical assets, highly innovative fintechs and renowned expert teams.

First payment operator to develop Apple Pay, Samsung Pay and instant payment in France. Natixis Payments draws on its expertise, founded on a combination of industrial savoir-faire and the agility of its Fintechs. Being a member of the Groupe BPCE, the second largest banking establishment in France, gives it the advantage of in-depth knowledge of the market and practices.

Our activities– Processing, Digital Payments and Benefits – are centered on a common ambition: the excellence of the product and the client experience.

Pierre-Antoine Vacheron, Chief Executive Officer of Natixis Payments

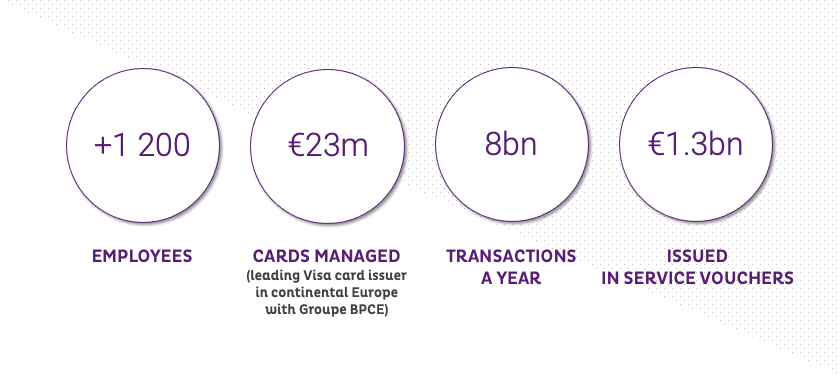

OUR KEY FIGURES

A comprehensive offer for all players in the economic sector

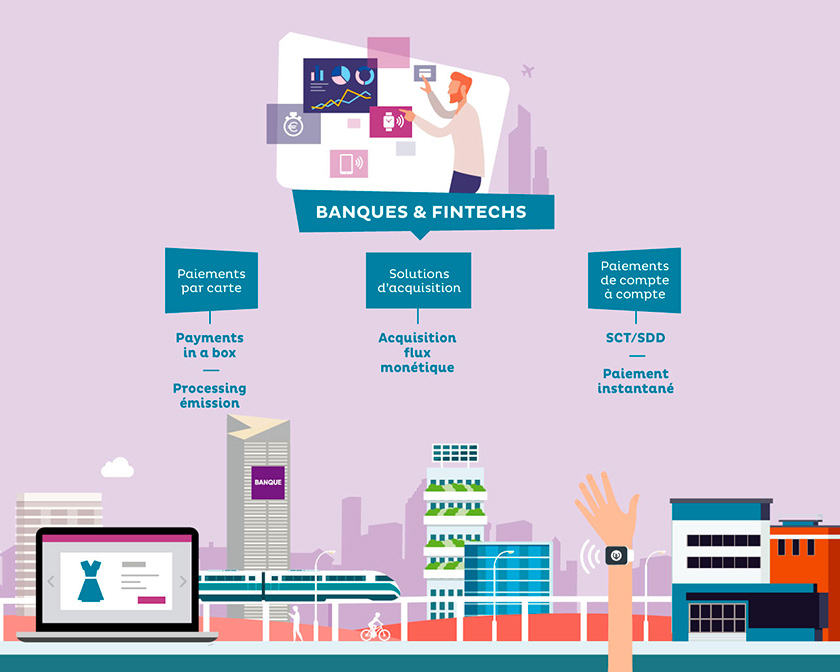

Natixis Payments solutions are aimed at individual clients, professionals, businesses and associates of Groupe BPCE networks, as well as retailers, banks and Fintechs:

- online and omni-channel payment solutions (acceptance, fight against fraud, payment terminals, open payment, centralized electronic payment…),

- card payments and issuance processing,

- merchant payment flow acquisition solutions,

- payments between accounts (SEPA transfers/direct debits, instant payments),

- employee benefits (restaurant vouchers, gift vouchers) and benefits for business committees.

Our strength: agility in the fight against fraud

Guarding against the risks of fraud by striking the right balance between transaction security and client experience (retailers, companies, consumers) is a crucial point in maintaining the clients’ confidence in their daily use of payment and receipt methods. The fight against fraud is part of a strict regulatory framework, and is subject to close surveillance by regulators (Banque de France, Banque centrale européene) and monitoring by l’Observatoire de la Sécurité des Moyens de Paiement (OSMP) which gathers statistics on fraud.

Being a member of the Groupe BPCE gives Natixis Payments a major advantage in the implementation of the DSP2 (Directive sur les Service de Paiement 2), the aim of which is to increase the security of electronic payments with strong systematic authentication of online payments.

Natixis payments has a 360° view of payments and an unparalleled knowledge of issuer data modelling, to help retailers optimize their conversion rate in the move to DSP2.

In the fight against fraud, Natixis Payments:

- Has a team of specialists in authentification; cryptography, datascience, security, expert systems

- Implements a leading approach on real-time and data technologies: Machine Learning, monitoring of cases of fraud, alerts and blocking of transactions

- Carries out active surveillance on fraudulent practices which are constantly adapting to developments in payment technology, aimed at all businesses in the Payments sector.

Our fintechs

We combine our longstanding expertise on electronic payment with the fully digital solutions of our fintechs.