Supporting our clients in their sustainable growth strategy

Climate change is one of the greatest challenges our world must face today. Our mission: expedite our clients’ ecological transition as a proponent of green finance.

As a founding bank of the Principles for responsible banking, Natixis is proud to support the Collective Commitment to Climate Action initiative.

We are committed to implementing new solutions to more closely align our financial portfolio with The Paris Agreement on climate change.

THE GREEN WEIGHTING FACTOR, our innovative tool at the service of ecological evolution

Natixis becomes the first bank to actively manage its balance sheet’s climate impact by means of its Green Weighting Factor . This new capital allocation tool classes each financial activity in terms of its impact on the climate with a grading from “brown” to “green”. A gradual system of bonus-malus is assigned to the most “green” financial activity (up to 50%) and to the most “brown” financial activity (up to 24%).

This approach in aid of the transition towards a low-carbon economy is carried out together with all of our clients in order to better support them in their sustainable investment strategy.

The Green Weighting Factor is a replicable tool that could be adopted by other banks committed to transitioning their portfolios

THE GREEN & SUSTAINABLE HUB (gsh), our CENTER of EXPERTISE

Our hub of cross asset experts based in Paris, New York and Hong Kong advises clients on issues relating to finance and investment in order to facilitate their ecological and social development.

We create innovative products with a positive environmental and/or social footprint in 8 core industries:

Energy (Oil & Gas, Electricity and Renewables) – Metals & Mining – Real Estate – Transportation – Telecoms and Tech – Environment – Healthcare – Insurance

We are fully committed to offering our clients from all over the world uniquely tailored, innovative solutions, and to supporting them in their own transition towards a more sustainable and durable economic model.

Building our identity on the basis of a mutually trusting relationship, we propose tailor-made solutions to suit your goals.

Our wide range of products allows you to maximize your financial transactions and commercial operations in complete security. In the belief that the success of your international projects always requires greater flexibility and performance, we put innovation at the heart of our strategy.

Our experts are by your side to help you overcome any challenges pertaining to cash management, liquidity management, security and financing of your international operations.

Our full range of value-added expertise

Day to day, we support our clients in order to help them overcome economic and regulatory challenges, and make a success of their ecological development. With this aim we provide a full range of tailored expertise around the world. We offer investment and financial solutions adapted to the clients’ needs and concerns:

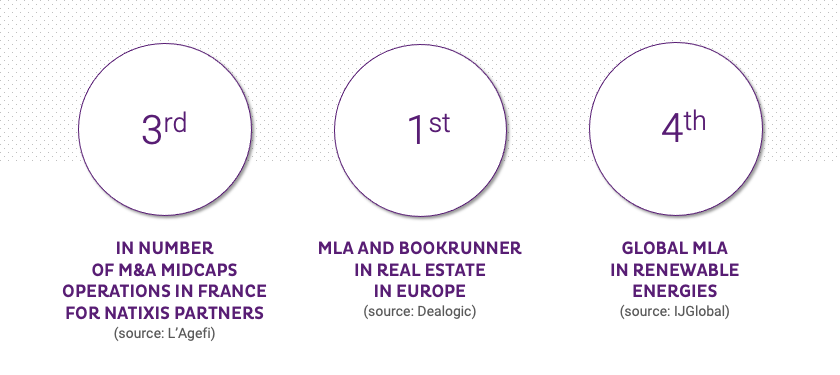

- Strategic advice: Investment Banking and Mergers & Acquisitions

- Capital Markets

- Structured Financing and Cinema financing

- Trade Finance, Treasury Solutions

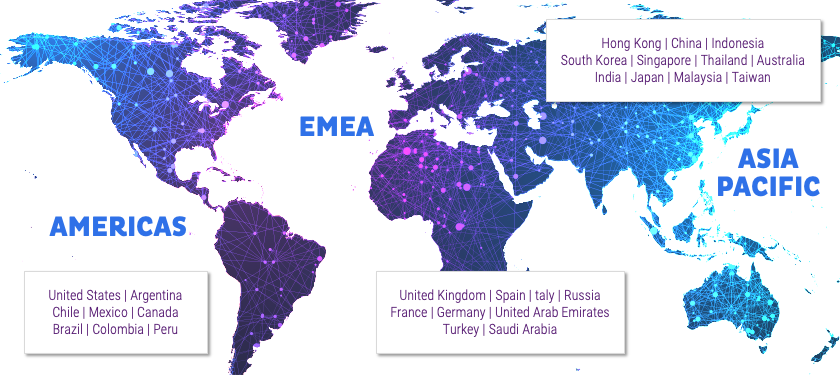

These ranges of expertise are available, with local specificities, on our three international platforms: EMEA, Americas and Asia Pacific.

A reputed global Research team

Our CIB Research team supports Natixis’ commercial approach. It publishes analyses to bring clarity to our clients’ decisions, and contributes to the creation of financial solutions adapted to their needs thanks to its macroeconomic and targeted expertise.

Our Mergers & Acquisitions model

Our experts in Mergers & Acquisitions operate around the world to manage acquisition procedures of significant scale, beyond the solely financial aspects. Their domains of expertise: Infrastructure – Energies and transition – Real estate – Financial services – Technologies – Financial sponsors – Retail.

An international dimension