As part of the 52nd International Air Show in Le Bourget from June 19 to 25, Ramki Sundaram, Global Head of Aviation Finance at Natixis, shares his view on the outlook for the aviation sector and on our initiatives to better serve our clients.

1/ What is the outlook for the Aviation sector? Is there a specific geographical area where you forecast high financing needs?

Aviation, as a sector, is experiencing strong growth supported by growing air travel demand, which in itself has been growing at a rate of 1.5 to 2.0 times global GDP. It is estimated, by Boeing and Airbus, that over the next 20 years, $5 trillion aircraft will be needed, one third for the replacement of older aircraft by new-generation fuel-efficient aircraft.

A significant portion of this demand (over 50%) is expected to come from Asian markets, especially China and India, which have large populations and cities that are hitherto not well connected. The Middle East has also been a big growth market capitalizing on its unique geographical location to be a major hub for aviation travel connecting the western world to various APAC destinations.

Another trend we have been witnessing is the increasing popularity of the Asian institutions to invest in aircraft leasing and their acquisition of both aircraft leasing companies and of aircraft assets. Frequent trading of aircraft leasing companies and/or aircraft also provide various acquisition and portfolio financing options for aviation banks like ourselves.

2/ Where does Natixis stand in the Aviation Finance industry? How does your multi-expert team provide added-value to our clients?

Natixis has been at the forefront of arranging large aircraft portfolio financings for Asian conglomerates who entered aviation leasing in the last few years. We led the USD 1.1bn portfolio financing for Accipiter as a Coordinating Lead Arranger (the deal went on to win the “Lessor Bank Deal of the Year” award by Air Finance Journal) and an USD 650m Sole Mandated Arranger and Bookrunner for Goshawk, both of which have very strong Asian sponsors.

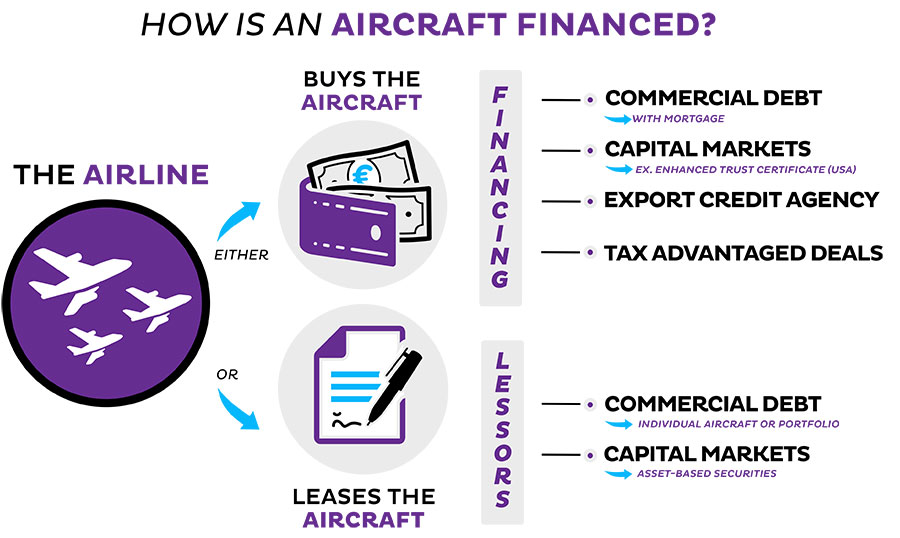

Natixis is one of the leading aviation banks with a strong track record of providing client-centric solutions to our airline clients and more recently expanded this to aircraft lessors which now own roughly 40% of the current operational aircraft. We are becoming an important force in the industry. This change in positioning has been aided by augmentation of our aviation finance team with different experience and expertise, including those gained through aircraft lessors, manufacturers, airlines and aircraft valuers apart from asset financiers.

With the help of this diverse team, we are able to provide innovative solutions to our clients including portfolio financing, aircraft leasing, tax structured financing and access to capital markets. We recently received several awards from Air Finance Journal for the transactions we led in 2016 across all these different streams.

3/ What are the initiatives implemented by Natixis to promote aviation as an attractive asset class for investors?

With the growth in our origination volumes, distribution has become a very integral and important part of our growth driver. Both the volume of aviation paper distribution and the number of participants on deals arranged by us experienced a double digit growth in the last 12 months. There has been a concerted push to significantly enhance our distribution reach to include all types of banks and institutions – various regional banks in the US, Europe, the Middle East and Asia, pension and insurance companies, hedge funds, private equity funds and specialist debt funds. This has been possible due to the global network of Natixis and working seamlessly with teams across various geographical platforms.

The marketing and educational outreach to investors has been conducted through a combination of one-on-one intensive meetings with the management and credit teams of the various institutions, and specific investor events like the Natixis Aviation Day in Paris in 2016 and the one in Abu Dhabi in early 2017, co-sponsored with Abu Dhabi Global Markets (ADGM).

Our recent sale and lease-back transaction for Etihad Airways with two aircraft being domiciled in ADGM, with Shariah-compliant investment opportunities, is a very good example thereof. We could reach across to a hitherto untapped investor base with the full support of the ground resources in the Middle East.

* A Euromoney publication