Why our assumptions about the next generation of investors may be all wrong.

Millennials are not who you think they are. Coming of age in a period of economic uncertainty, individuals born between 1980 and 2000 have been stereotyped as recent college grads who can’t find meaningful work. They’re forced to move into their parents’ basements. They’re faulted for living in a limbo somewhere between adolescence and adulthood. They’re criticized for being self-obsessed. They’re chided for clinging to their mobile phones as a lifeline. Worse yet, they’ve been ignored by a financial industry that believes they have no money and little interest in building personal wealth.

While these are the stereotypes of Millennials, the truth about the 2 billion individuals globally born between 1980 and 2000 is something altogether different. Many are no longer “kids.” The oldest members turn 37 years old this year. They’re nearing 40. They’re raising families, buying homes and they are an economic force. In 2017, the Natixis Investment Managers Global Survey of Individual Investors1 finds that they are developing a unique outlook on the markets and investing. The financial industry needs to recognize who they are and how they’re different from other investors.

Hereunder are the most important insights of Natixis Investment Managers survey “Breaking the Millennial Myth”.

Insight 1: Millennials are no slackers, but they still need some direction

But as younger investors, this group holds a relatively short-term investment outlook. More than six in ten (64%) say the time horizon for their investments is five years or less, while 87% say it is less than ten.

Insight 2: Millennials are more conservative than you think

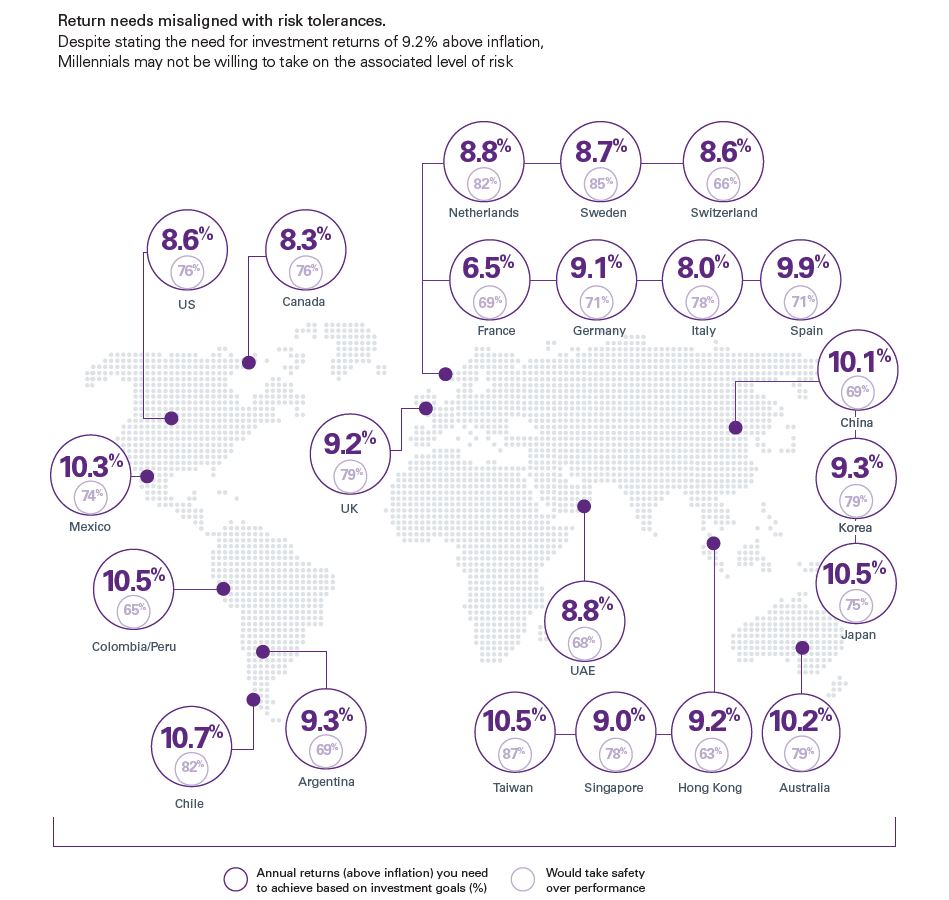

Millennials may not be willing to take on the associated level of risk.

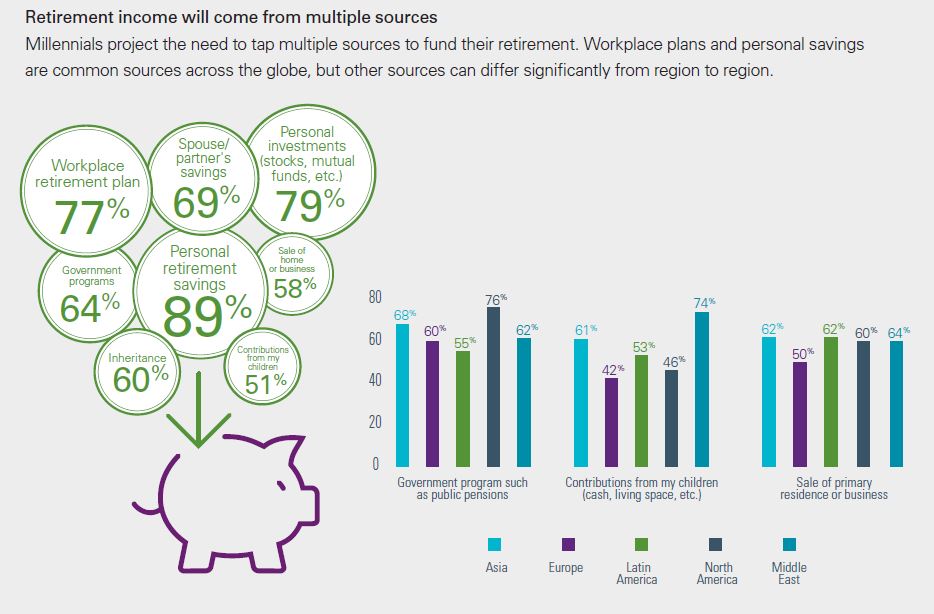

Insight 3: Millennials take responsibility for retirement funding, but many will count on family to get by

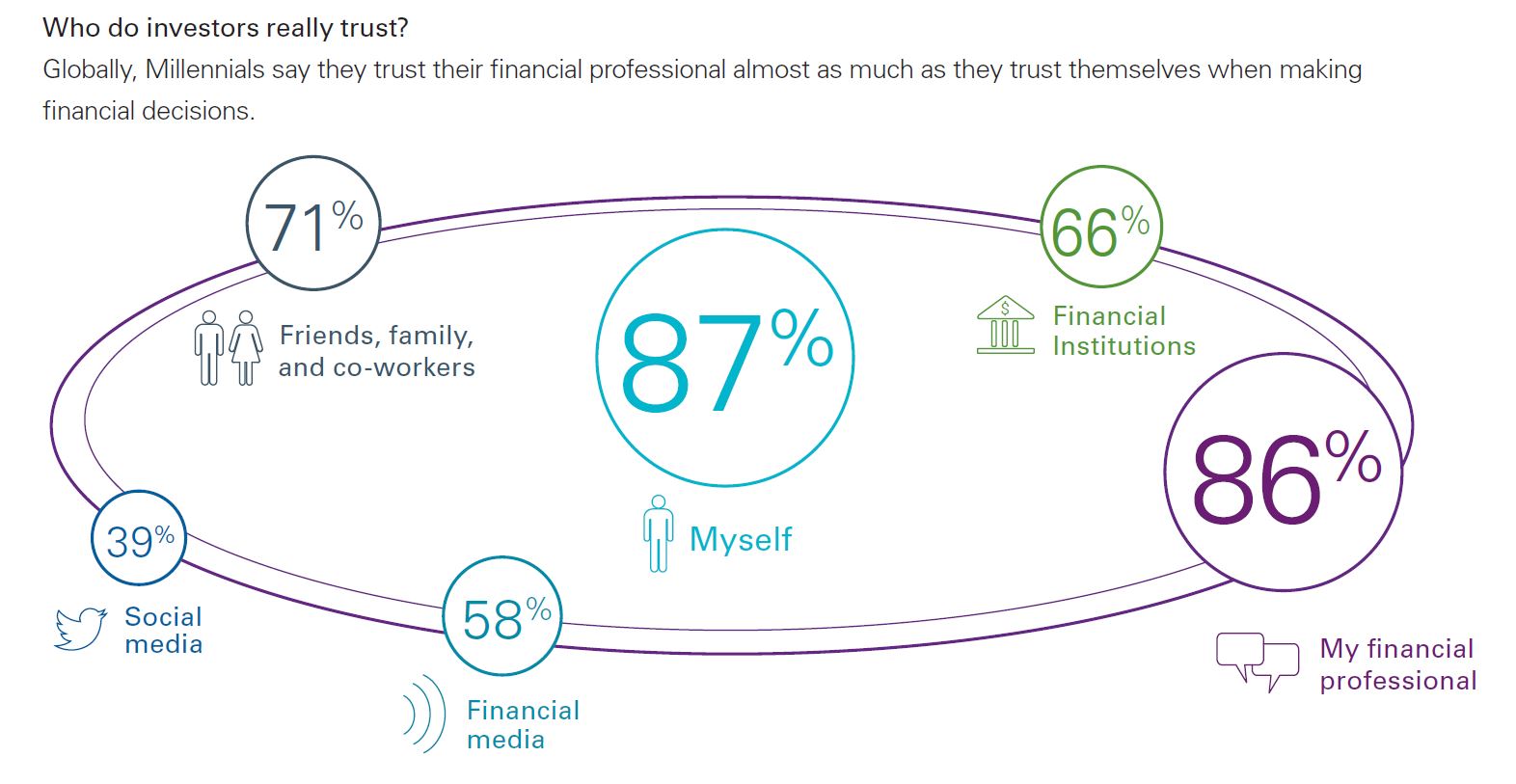

Insight 4: Millennials may actually trust people more than their phones

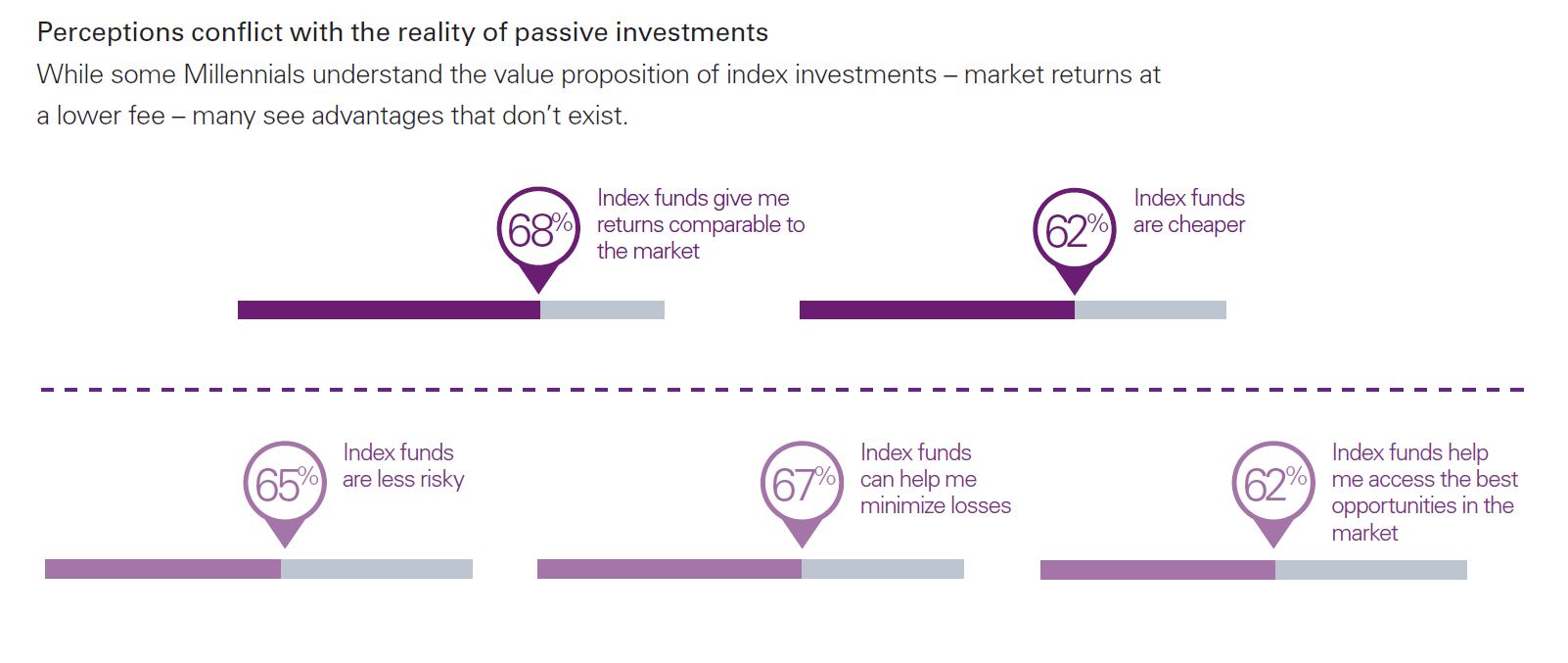

Insight 5: Despite their misconceptions about passive investments, Millenials have clear expectations for active managers

Many Millennials have significant misconceptions about what passive investments can and cannot do. More than six in ten (62%) believe passive investments provide access to the best investment opportunities. But 68% say they expect their mutual funds to have a portfolio of securities that is substantially different from the benchmark index and seven in ten (69%) say they prefer to have an expert find the best investment opportunities.

Insight 6: Value investing may have a different meaning for Millennials

ABOUT THE SURVEY

Natixis Investment Managers surveyed 8,300 investors globally in February and March of 2017, with the goal of understanding their views on the markets, investing and measuring progress toward their financial goals. Investors from 26 countries are represented in this, the eighth annual survey of individual investors. Of the 8,300 investors surveyed, 2,434 are Millennials.

An online quantitative survey of 41 questions was developed and hosted by CoreData Research. The survey is focused on individuals with US $100,000 (or Purchase Price Parity [PPP] equivalent) or more in investable assets. In the 2017 survey, this threshold was lowered from $200,000 in order to capture a larger pool of younger investors. As a result, Millennials in our sample are high earners – 44% report annual household incomes of $50,000 to $150,000 and 45% report investable assets, excluding their home value, between $100,000 and $400,000. Based on personal wealth, they may represent influencers within the larger Millennial population and serve as an indicator of where sentiment may be heading as this population ages and attains higher levels of earnings and wealth.

1 Natixis Investment Managers, Global Survey of Individual Investors conducted by CoreData Research, February-March 2017. Survey included 8,300 investors from 26 countries.